‘Find buyers before agents!’ Mortgage industry reacts to the NAR settlement

Housing Wire

MARCH 15, 2024

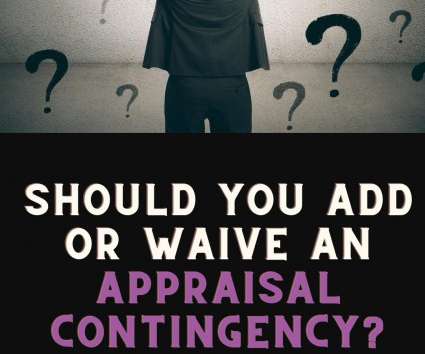

These housing professionals have been gaming out the potential impact on buyers’ agents – a significant source of referrals. Loan officers and mortgage executives expect home sellers and homebuyers to negotiate more aggressively on commission paid to buyer agents, potentially bringing costs down.

Let's personalize your content