Elevated mortgage rates aren’t discouraging homebuyers

Housing Wire

JUNE 14, 2025

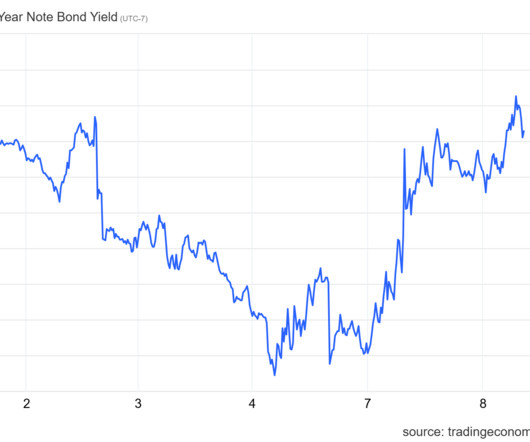

Right now we have elevated mortgage rates , trade war uncertainty , rising property taxes and home insurance, terrible consumer confidence data and a downgrade of the government’s debt, among other factors. Typically, mortgage rates around 6% are necessary for significant growth in the housing market.

Let's personalize your content