Closing the gap: How Rocket Close has streamlined its platform experience

Housing Wire

JUNE 26, 2025

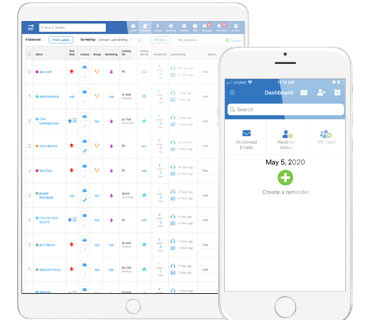

Rocket Close and Rocket Pro have taken a major step forward by integrating the two platforms into a single, more efficient platform, designed to simplify the closing process and enhance the broker experience. HousingWire: Rocket Close has recently undergone a bit of a change. No logging into another system.

Let's personalize your content