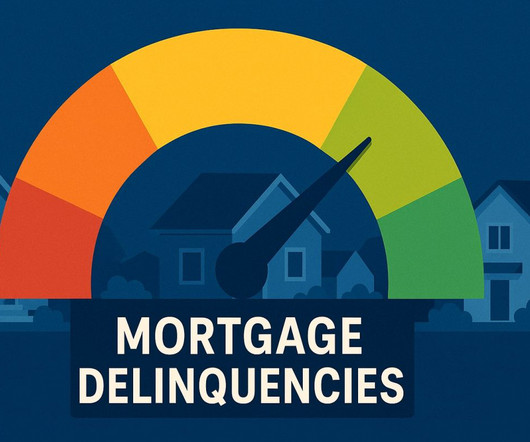

FHA loans dominate delinquencies in ICE’s ‘first look’ report

Housing Wire

MARCH 21, 2025

Today’s first look at the data revealed that FHA mortgages accounted for 90% of the 131,000 year-over-year rise in the number of delinquencies , despite making up less than 15% of all active mortgages.

Let's personalize your content