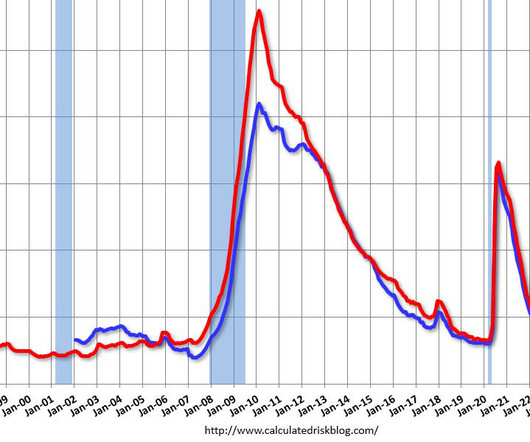

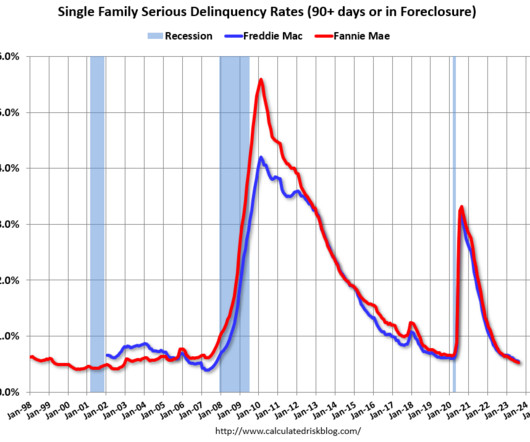

U.S. mortgage delinquency rates remain near historic lows: CoreLogic

Housing Wire

APRIL 26, 2024

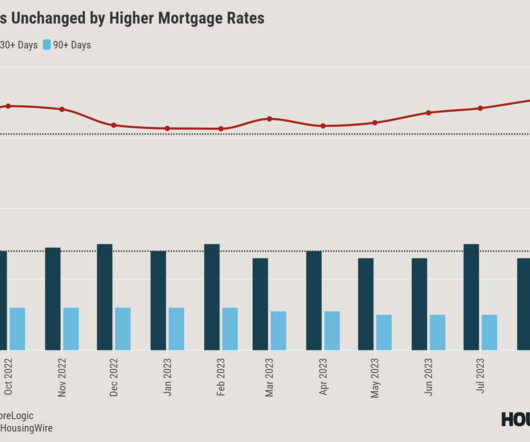

The rate remained unchanged from January 2024, according to the latest CoreLogic Loan Performance Insights report. The data provider examined all stages of delinquencies to gain a complete view of the mortgage market and loan performance health. Early-stage delinquencies (mortgages 30 to 59 days past due), accounted for 1.5%

Let's personalize your content