Fannie Mae unveils $997M reperforming loan offering

Housing Wire

AUGUST 12, 2022

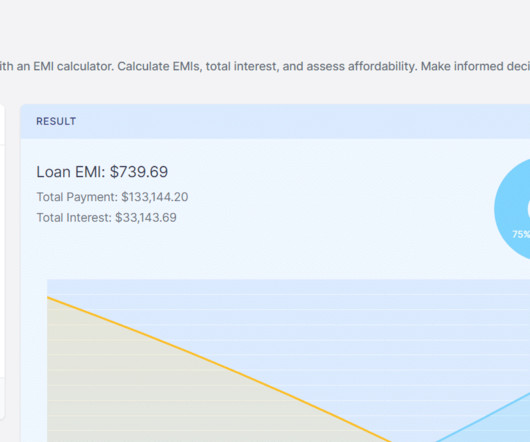

Fannie Mae has launched its fourth reperforming-loan sale of the year — an offering of 6,130 loans with an unpaid principal balance of $997 million. A reperforming loan is a mortgage that has been or is currently delinquent but has been reperforming for a period of time. million; and pool 3, $312.9

Let's personalize your content