U.S. mortgage delinquency rates remain near historic lows: CoreLogic

Housing Wire

APRIL 26, 2024

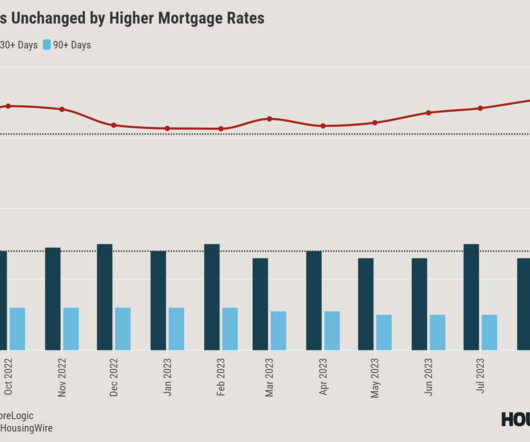

The data provider examined all stages of delinquencies to gain a complete view of the mortgage market and loan performance health. Early-stage delinquencies (mortgages 30 to 59 days past due), accounted for 1.5% As later-stage delinquencies decrease, the share of mortgages in foreclosure remained at 0.3% percentage points.

Let's personalize your content