ICE Mortgage Monitor: The Impact of "Golden-Handcuffs" on Mortgage Payments

Calculated Risk Real Estate

APRIL 1, 2024

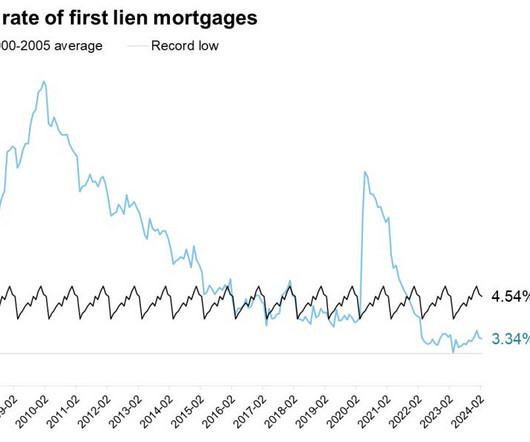

Leveraging the ICE Home Price Index and our loan level mortgage data, we looked at how much it would cost the average homeowner with a mortgage to trade up to a 25% more expensive home in today's market – or to simply move across the street, for that matter, into a home identical to their own. .

Let's personalize your content