How Andrew Marquis plans to close more loans in a low-inventory market

Housing Wire

JANUARY 31, 2023

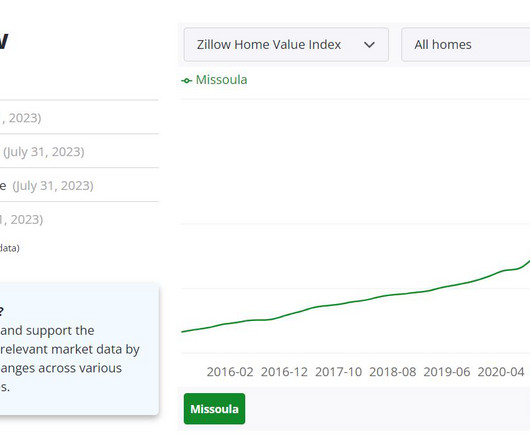

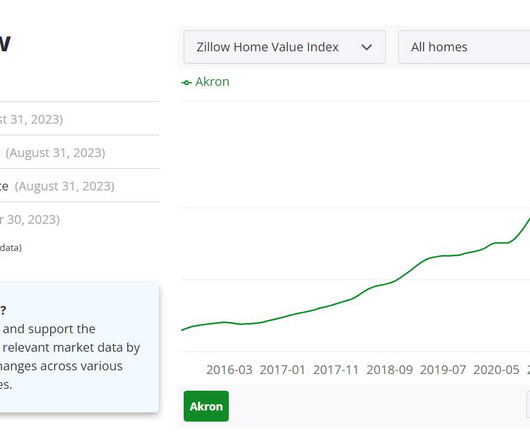

Even if I write seven pre-approvals a day, when there is one house and there’s 20 people that want to buy the same house, we still can’t do a lot of deals,” Marquis said. Connie Kim : We’ve seen a lot of optimism for the mortgage industry, mainly due to rates on a declining trend. Marquis: I would say half and half.

Let's personalize your content