Property taxes have been rising. Here’s what it means for housing

Housing Wire

NOVEMBER 7, 2023

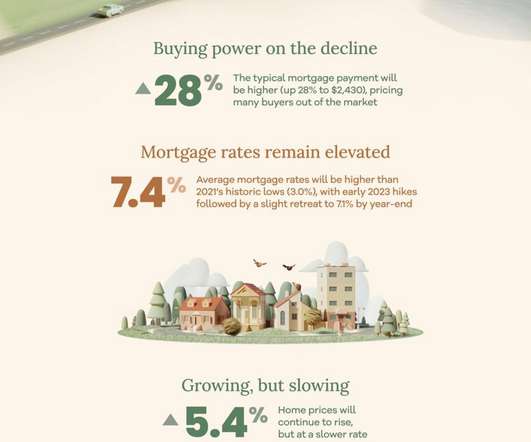

It is costing more for schools and governments to pay for services. That, combined with higher home valuations from sales last year, has meant that the average homeowner will pay an extra $130 annually in tax through fiscal year 2024, according to the county. single-family home was $3,901, up 3% compared to 2021, ATTOM reported.

Let's personalize your content