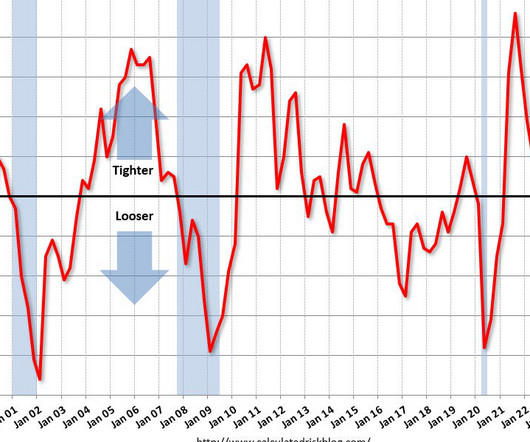

Opinion: How did homeowners get into home equity prison?

Housing Wire

MARCH 26, 2024

As the person relaxes on the couch watching television at night, they occasionally check the current value of their home and do a rough calculation of the amount of equity that they have accrued. Stated differently, you are dealing with individuals that may be in an equity prison. It comforts them for a brief moment.

Let's personalize your content