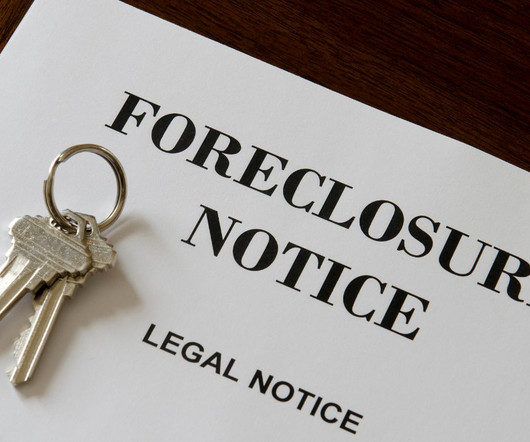

How to find foreclosure leads and turn them into clients

Housing Wire

AUGUST 5, 2025

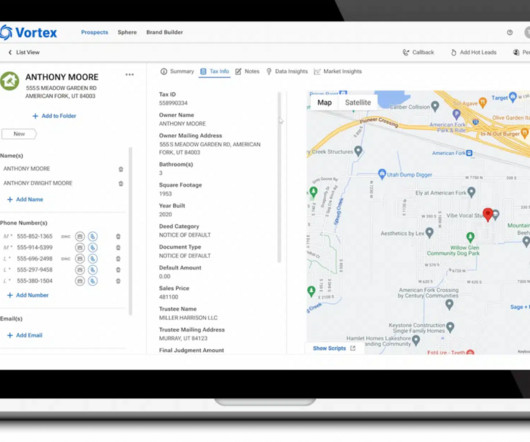

This guide walks you through some of the best ways to find foreclosure leads, whether you’re working your local market or casting a wider net. Whether you prefer data at your fingertips or boots-on-the-ground prospecting, here are 10 effective ways to uncover foreclosure opportunities in your market.

Let's personalize your content