Housing credit data in Q4 looks nothing like 2008

Housing Wire

FEBRUARY 8, 2024

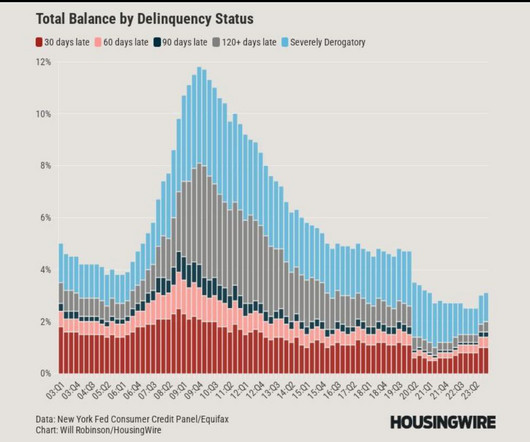

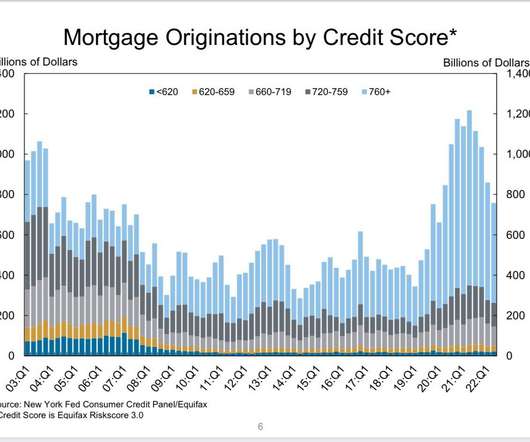

Bankruptcies and foreclosures After 2010, the qualified mortgage laws came into play and all the exotic loan debt structures in the system, especially in the run-up in demand from 2002 to 2005, disappeared. Then add three refinancing waves in 2012, 2016 and 2020-2021, and you can see why homeowners are in a good spot.

Let's personalize your content