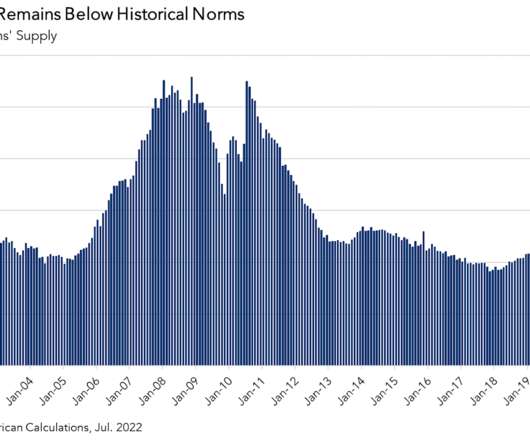

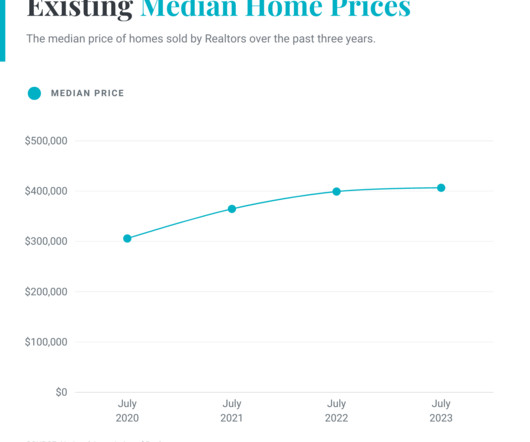

Why higher rates aren’t crashing home prices

Housing Wire

JUNE 9, 2023

In 2022 it was all about finding a point in time when I thought mortgage rates would fall, which was key to understanding how the purchase application data would react to lower mortgage rates. We have had plenty of times in the previous decade when mortgage rates fell and demand improved, but that was with a lot lower mortgage rates.

Let's personalize your content