Opinion: The ripple effect on the U.S. housing market from China’s real estate crisis

Housing Wire

OCTOBER 5, 2023

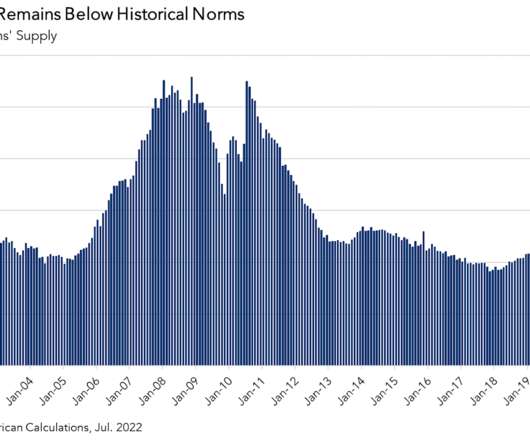

Lax lending standards and cheap credit, plus a popular belief that real estate values never decline, created a massive bubble. Despite the risks, there are multiple ways events in China could end up benefitting residential real estate in the US. Following a pattern eerily similar to the U.S. in 2008 and 2009.

Let's personalize your content