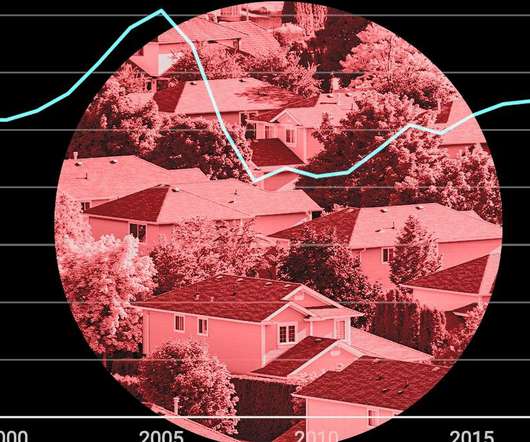

Mortgage rates should drop below 7% as housing demand picks up

Housing Wire

DECEMBER 2, 2023

What a week! Mortgage rates almost fell below 7%, the 10-year yield is below 4.25% again, and people are seriously talking about Fed rate cuts in 2024. Mortgage rates and the 10-year yield We are back! The 10-year yield closed below 4.25% again and mortgage rates ended the week at 7.09%. In Q3, the U.S.

Let's personalize your content