Hometap reaches $1B in home equity investments

Housing Wire

FEBRUARY 13, 2024

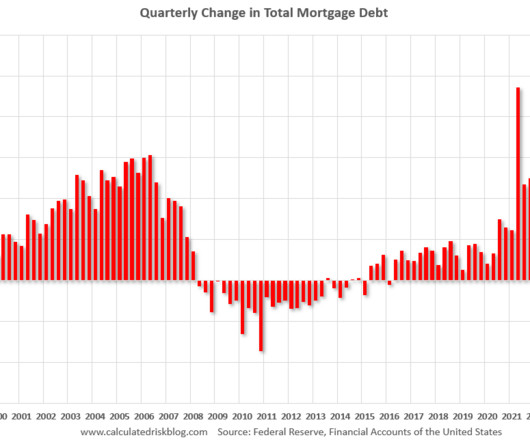

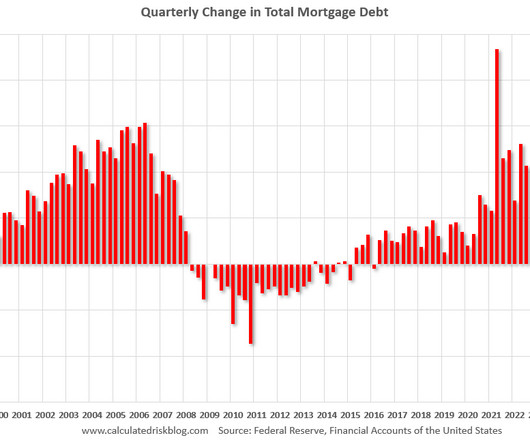

homeowners with outstanding mortgages, or some 63% of all homes, equity tied up in real estate jumped by 6.8% It features tools for data visualization of home value, mortgage debt and current equity, as well as estimates for up to 10 years. The borrower is not required to repay the loan via monthly installments.

Let's personalize your content