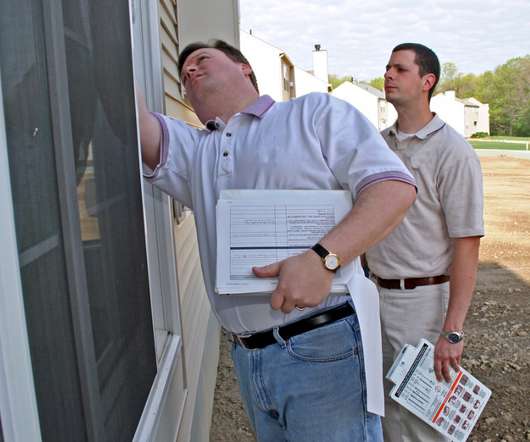

The home inspection process: Should you skip it?

Housing Wire

JANUARY 26, 2021

People often confuse the home appraisal with the home inspection. Appraisals are estimates of a home’s value — and they’re typically required before you can close on your mortgage loan. Inspections, on the other hand, are designed to assess the condition of the home, and they’re 100% optional for the buyer. Projects to avoid.

Let's personalize your content