Mortgage market consolidates around largest nonbank firms: Fitch

Housing Wire

MARCH 12, 2024

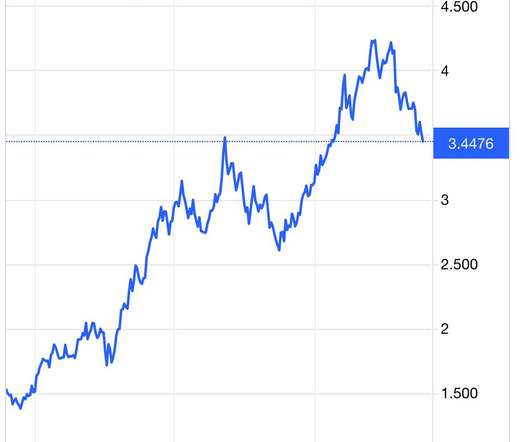

nonbank mortgage lenders continue to gain market share as the industry consolidates and a number of smaller players exit the space due to a lack of strong franchises to retain sufficient volume, Fitch Ratings reported Tuesday. Fairway Independent Mortgage Corp. Rocket Mortgage had purchase origination volume of $47.5

Let's personalize your content