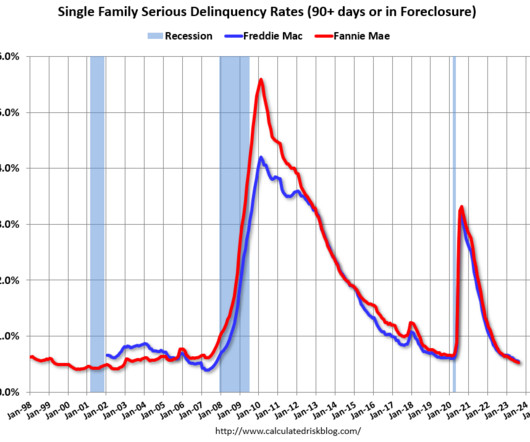

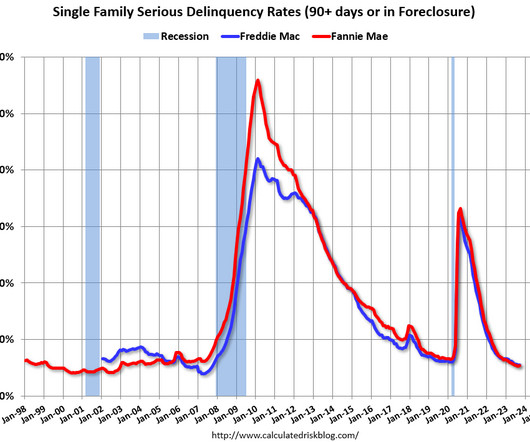

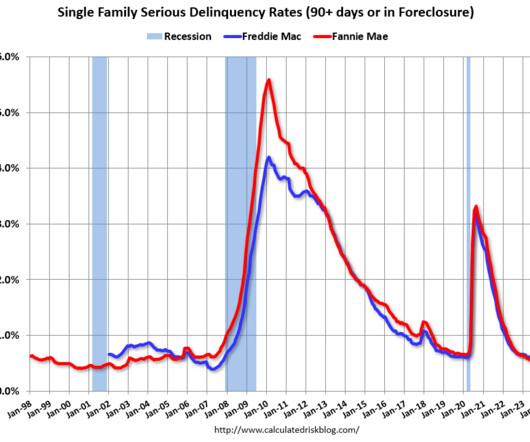

U.S. mortgage delinquency rates remain near historic lows: CoreLogic

Housing Wire

APRIL 26, 2024

The data provider examined all stages of delinquencies to gain a complete view of the mortgage market and loan performance health. Early-stage delinquencies (mortgages 30 to 59 days past due), accounted for 1.5% home equity , which was up by $1.3 of all mortgages in February, up 10 basis points year over year. percentage points.

Let's personalize your content