Despite lack of supply, existing home sales rise 6.7%

Housing Wire

FEBRUARY 18, 2022

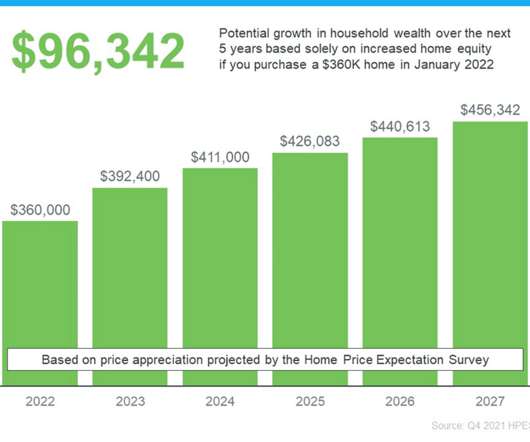

Homebuyers flocked to what little inventory existed in January, with existing-home sales rising 6.7% January sales fell 2.3% The supply of homes for sale fell to a record low, down 16.5% The supply of homes for sale fell to a record low, down 16.5% Sales of homes priced above $1 million were up 39%. .

Let's personalize your content