Bond investor PIMCO bets on home-equity market

Housing Wire

NOVEMBER 16, 2021

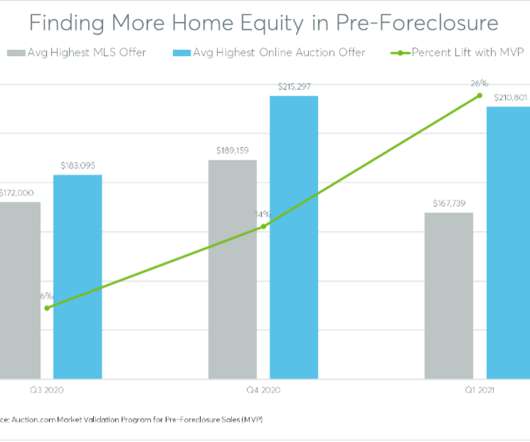

Rising home prices continue to fuel the growth of the nation’s multi-trillion dollar home-equity market, a fact not lost on behemoth investment-management firm PIMCO. Learn about the tools lenders should leverage to streamline home equity title and closing. The loans are serviced by Rushmore Loan Management Services.”.

Let's personalize your content