Here’s How to Use a Down Payment Calculator to Help Set a Home Budget

HomeLight

AUGUST 31, 2021

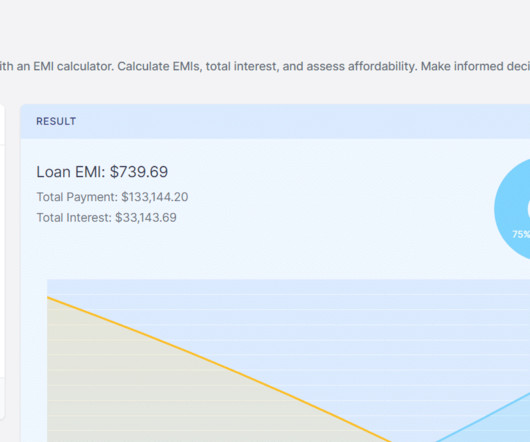

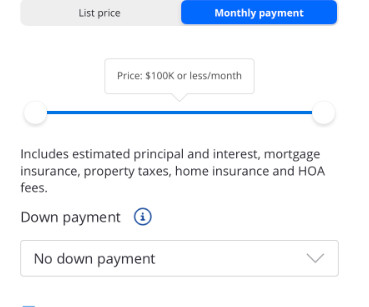

But there’s one major thing standing in your way: The down payment. A down payment calculator might be your new best friend. A down payment calculator is super easy to use and can be a great tool to understand how much you’ll need to put down on your new home. How much do you need?

Let's personalize your content