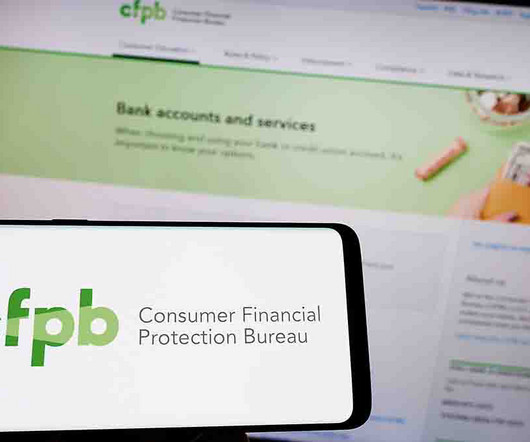

To boost Black homeownership, the U.S. must navigate a ‘troubling environment’

Housing Wire

NOVEMBER 13, 2024

The past two years have been tough, but even before 2021, Black homeownership was either falling or stagnant and remains far from its pre-2004 high of nearly 50%.” Lower-income Black and white mortgage applicants were also found to be paying higher interest rates in general than those of greater means, the report said.

Let's personalize your content