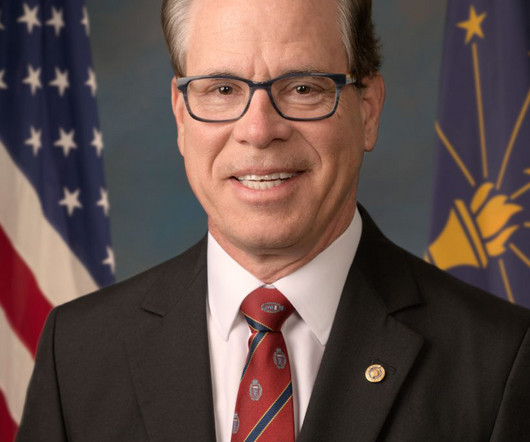

Tane Cabe talks reverse mortgage industry challenges, software development

Housing Wire

MARCH 20, 2024

Reverse mortgage industry veteran Tane Cabe recently left his position at Fairway Independent Mortgage Corp.’s s reverse division to transition back into a role as a reverse mortgage broker. People are interested in getting reverse mortgages and talking about them,” he said. I really do like that,” Cabe said.

Let's personalize your content