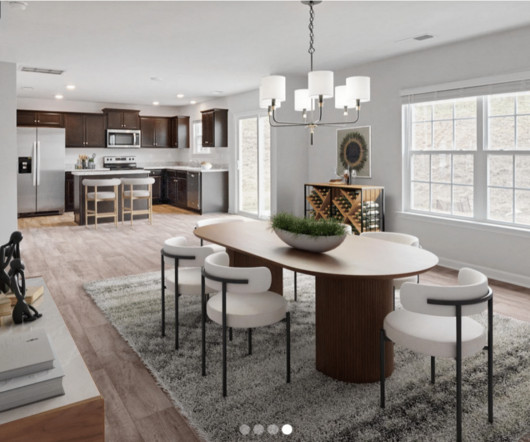

Help Your Clients Save Thousands with a VA Loan Assumption

Lab Coat Agents

MAY 1, 2024

VA loan assumptions offer a fantastic opportunity for your clients to save thousands on their mortgage in a rising interest rate environment. What is a VA Loan Assumption? What is a VA Loan Assumption? When a buyer assumes a VA mortgage loan, they take over the seller’s existing loan balance and current interest rate.

Let's personalize your content