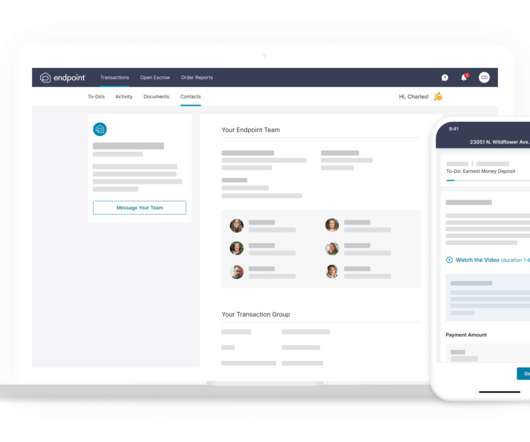

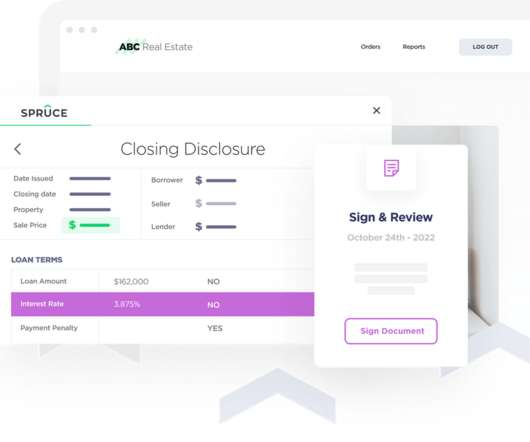

Black Knight’s Expedite Close eClosing solution uses automation to select the best way to close each loan

Housing Wire

AUGUST 1, 2021

More than ever, borrowers want and expect to close their loans digitally, from the initial loan application through the final review and approval of their loan package. But while eClosings are convenient, it can be challenging to offer the same level of customer service online as with in-person closings.

Let's personalize your content