How to Use Divorce Buyout and Home Value Calculators

HomeLight

MAY 16, 2024

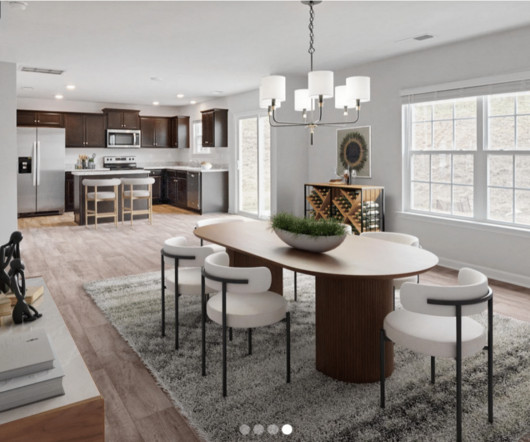

For the purposes of this post, we’ll focus on online tools that can provide helpful information in the early stages of decision-making. A divorce buyout calculator is an online tool designed to help divorcing couples determine how much one spouse would need to pay to buy out the other’s share of their joint home.

Let's personalize your content