Year-end pricing strategies: How to position your listings for maximum appeal

Housing Wire

NOVEMBER 26, 2024

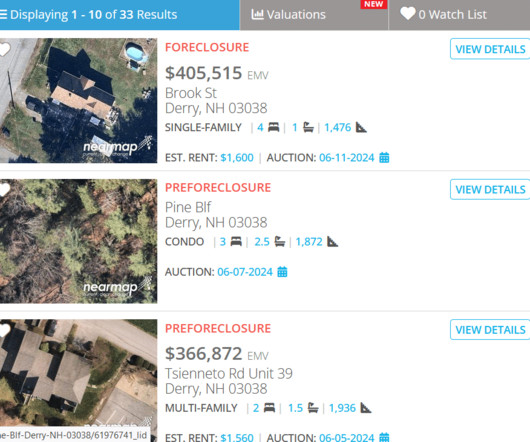

This price cut might attract budget-conscious buyers or investors looking for a deal and can be framed as a limited-time offer. In addition, the end of the year may find some buyers motivated to invest proceeds from a previous home sale to avoid a big tax hit; investors might also be looking for something that minimizes their tax burden.

Let's personalize your content