How to Use Divorce Buyout and Home Value Calculators

HomeLight

MAY 16, 2024

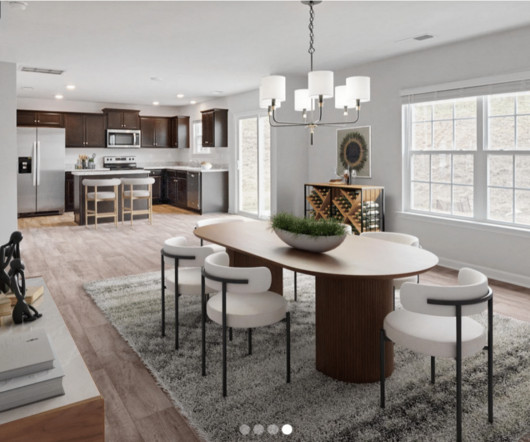

Keep the house and sell at a later time: Sometimes, couples choose to keep the home temporarily , often for the stability of children or to await better market conditions. For the purposes of this post, we’ll focus on online tools that can provide helpful information in the early stages of decision-making.

Let's personalize your content