Opinion: The evolution of the independent mortgage bank

Housing Wire

SEPTEMBER 12, 2023

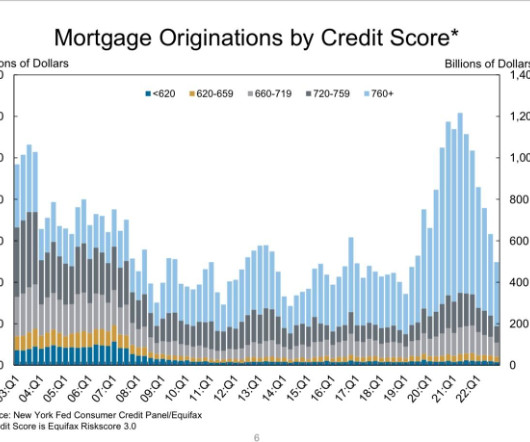

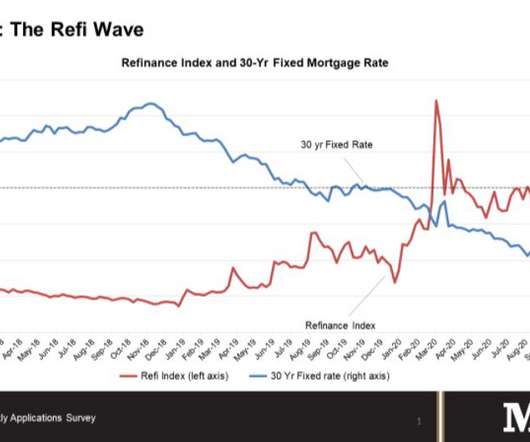

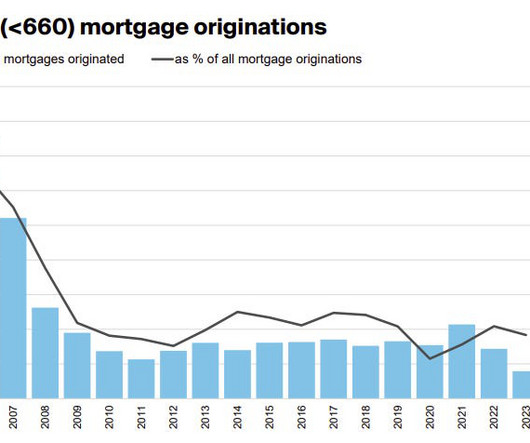

These current mortgage markets are what make it challenging for independent mortgage banks (IMBs). The fate of the specialist when the market shifts The independent mortgage banks most of us think of when someone mentions IMBs originated as a result of the Savings and Loan Crisis of the 1980s.

Let's personalize your content