3 underrated mortgage products to consider

Housing Wire

MARCH 1, 2021

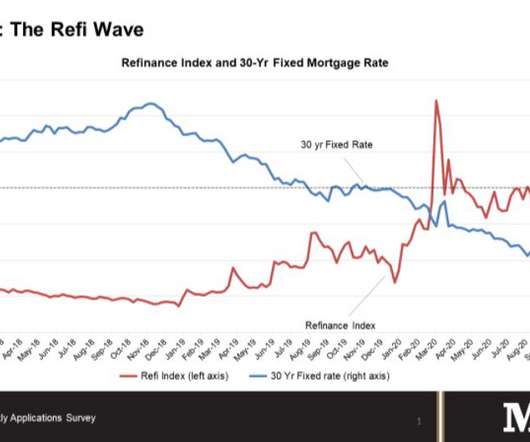

These mortgages come with lower interest rates, a quicker payoff timeline and the opportunity to build equity much faster than 30-year loans. And who couldn’t use an extra $60,000 in the bank?). Streamline refinances (if you have an FHA or VA loan). Streamline refinances (if you have an FHA or VA loan).

Let's personalize your content