The title industry’s latest cat-and-mouse game: seller impersonation fraud

Housing Wire

MAY 26, 2023

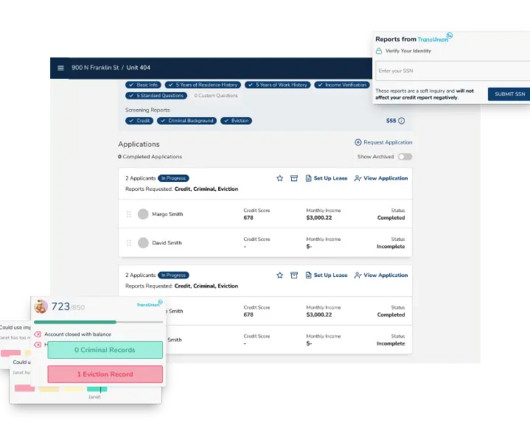

Secret Service , notified the title industry of a rise in what is known as vacant lot fraud, or seller impersonation fraud. “We The scammer then impersonates the notary and returns falsified documents to the title firm or closing attorney involved in the transaction. The title firm then transfers the closing proceeds to the scammer.

Let's personalize your content