How to find foreclosure leads and turn them into clients

Housing Wire

AUGUST 5, 2025

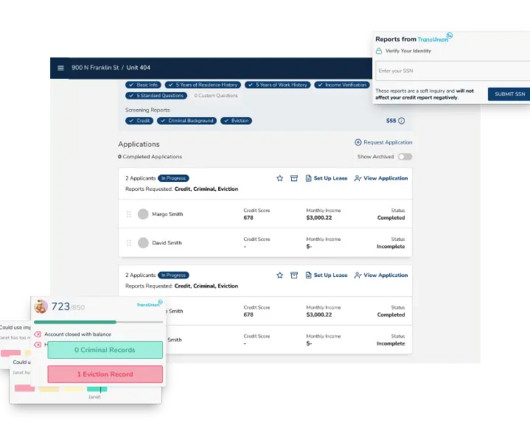

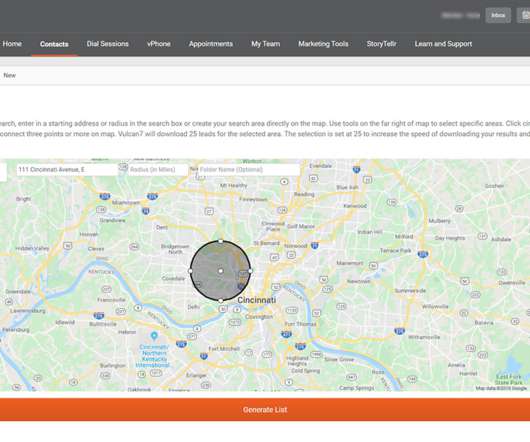

Network with real estate attorneys and bankruptcy professionals When someone’s in financial trouble, their first call usually isn’t to a real estate agent – it’s to an attorney. That’s why real estate attorneys, bankruptcy lawyers and even probate professionals can be incredible sources of foreclosure leads. That’s where you come in.

Let's personalize your content