The current REO market requires an expansion of services for business growth

Housing Wire

FEBRUARY 22, 2024

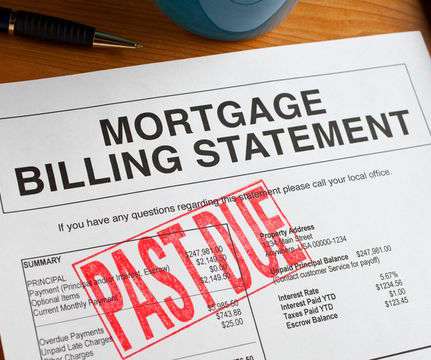

Tiffany Fletcher: Real Estate Owned (REO), acquired by lenders , banks, or financial institutions typically due to mortgage loan defaults, involves the strategic marketing and sale of existing properties to mitigate losses on outstanding loans. HW: What are the risk management challenges for REO assets?

Let's personalize your content