Housing inventory fell last week, but it won’t derail the spring bump

Housing Wire

APRIL 6, 2024

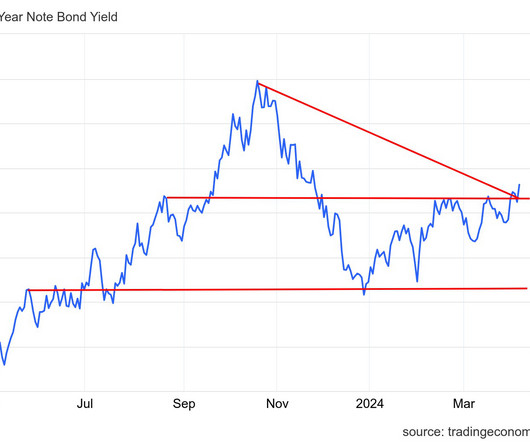

Also, spreads between the 10-year yield and the 30-year mortgage got better last week, which is a big plus for the future if this trend continues. My model has active inventory growing at least 11,000-17,000 every week with higher rates. It’s critical to keep track of this data line as it shows price growth cooling down.

Let's personalize your content