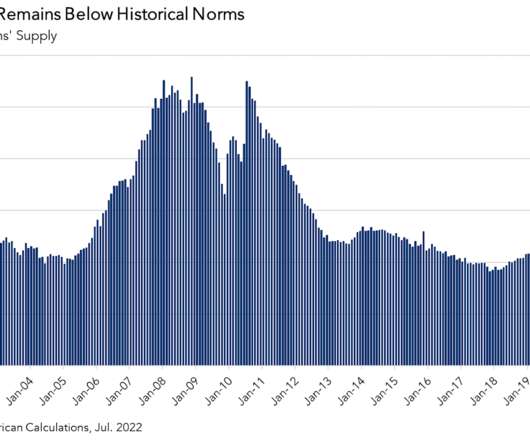

Housing inventory fell last week, but it won’t derail the spring bump

Housing Wire

APRIL 6, 2024

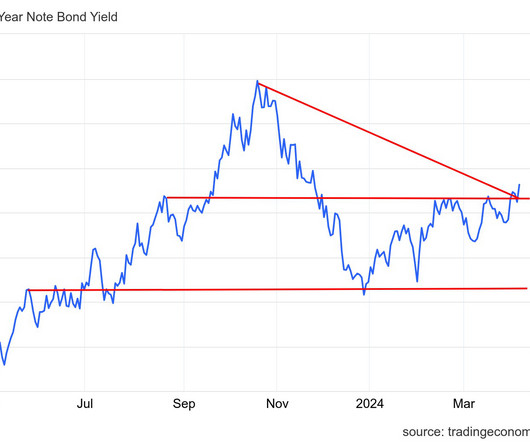

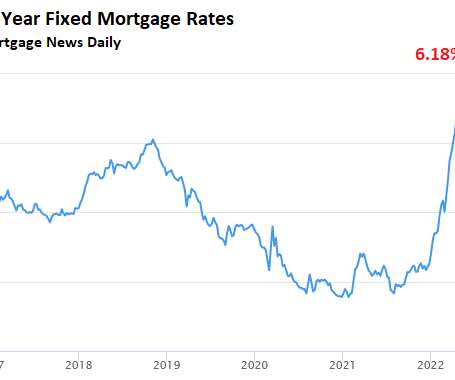

Also, spreads between the 10-year yield and the 30-year mortgage got better last week, which is a big plus for the future if this trend continues. This model was based on rates over 7.25% , but even when mortgage rates headed toward 8% last year, we didn’t see that kind of growth in inventory.

Let's personalize your content