CrossCountry Mortgage unveils cash-offer loan product

Housing Wire

FEBRUARY 22, 2024

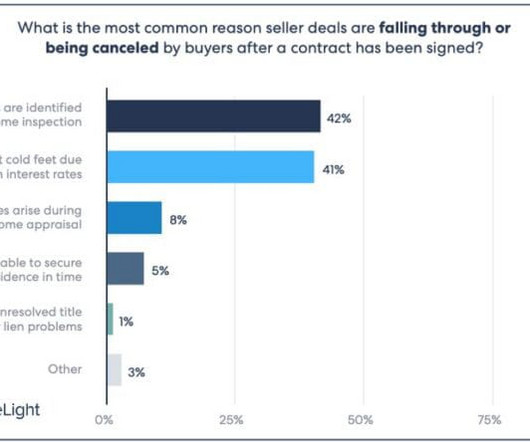

CashPlus has no appraisal or financing contingencies. The product is limited to conventional loans, primary residences and buyers who are represented by a real estate agent. “In

Let's personalize your content