Mortgage delinquencies edged higher in November: ICE

Housing Wire

DECEMBER 21, 2023

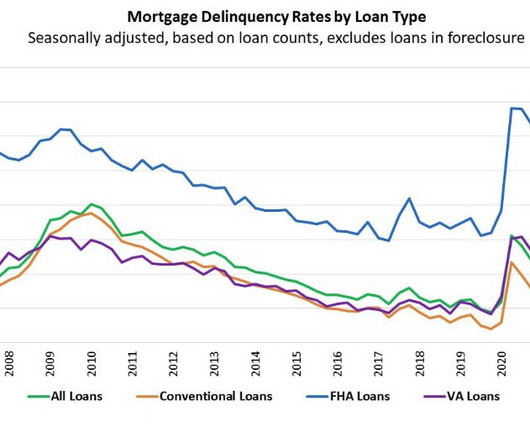

Meanwhile, early-stage delinquencies (30 and 60 days past due) continued to increase. In November, 70,000 additional borrowers were 30 days or more late on their mortgage payments, amounting to 1,804,000 loans. Moreover, early-stage delinquencies among VA loans hit their highest non-pandemic levels since 2009.

Let's personalize your content