FinLocker says it will cover 100% of mortgage verification costs

Housing Wire

MARCH 27, 2025

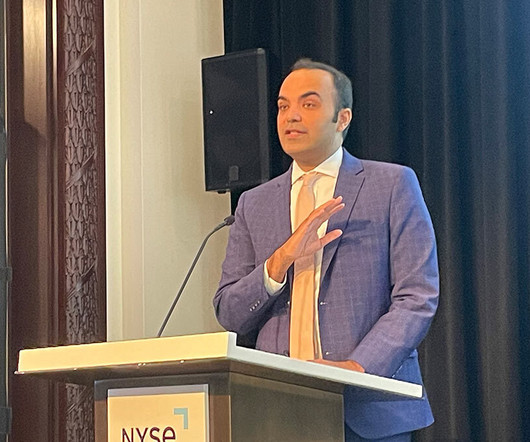

Self-branded “financial fitness” platform FinLocker announced Wednesday that it will cover 100% of the verification costs for mortgage borrowers who use lenders’ FinLocker-powered apps. This is about fundamentally transforming how the mortgage ecosystem works together.”

Let's personalize your content