Housing costs continue to burden American families: NAHB

Housing Wire

MAY 23, 2024

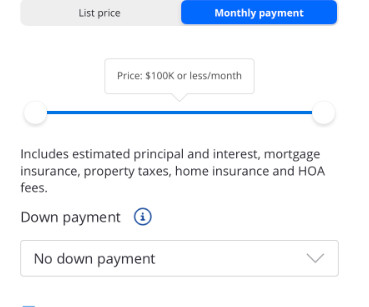

In the first quarter of 2024, 38% of a typical household’s income was needed to make a mortgage payment on a median-priced, new single-family home in the U.S. That’s according to the Cost of Housing Index (CHI) unveiled Thursday by the National Association of Home Builders (NAHB) and Wells Fargo.

Let's personalize your content