What to Do if Your Pre-approval For a Mortgage Expires?

Realty Biz

AUGUST 21, 2023

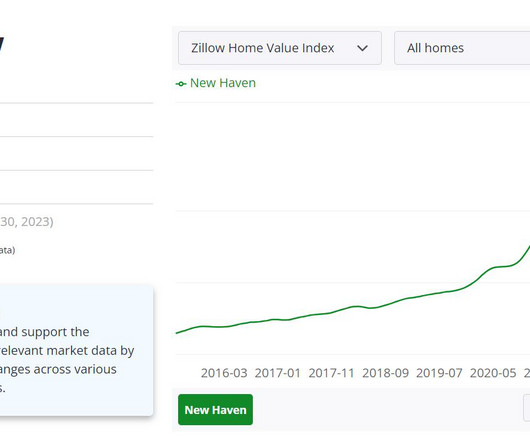

When your mortgage pre-approval expires, it can impact your home-buying process. A pre-approval is crucial in determining your loan eligibility and understanding your purchasing power. A mortgage pre-approval is typically good for 60-90 days , so it is crucial to remember this time frame.

Let's personalize your content