CoreLogic’s John Rogers on AI, climate risk and land development issues

Housing Wire

NOVEMBER 19, 2024

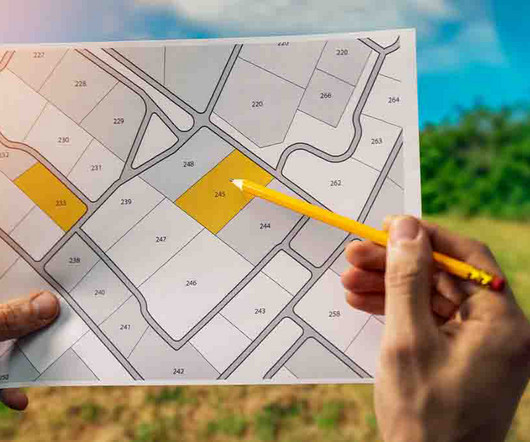

John Rogers is a well-known name in the world of mortgage and real estate data analysis. Rogers met with HousingWire to discuss his new role and cover a variety of topics, including artificial intelligence (AI), climate risk and land development. NP: You work directly with land developers too. We can now do that in an afternoon.

Let's personalize your content