Introducing the 2025 Marketing Leaders!

Housing Wire

JUNE 2, 2025

HousingWires Marketing Leaders award celebrates the most creative and influential marketing minds of the housing economy. This year 55 honorees were selected.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Housing Wire

OCTOBER 29, 2024

This invasive and often abusive marketing blitz, known as “ trigger leads ,” can open the door to identity theft, fraud and predatory lending—ultimately harming borrowers who are in pursuit of their dream of homeownership.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Housing Wire

SEPTEMBER 16, 2022

With the passage of HR 7735, known as the “Improving access to the VA home loan benefit Act of 2022,” the VA is now permitting desktop appraisals and in some circumstances, waiving appraisals altogether. House of Representatives this week passed a bill that streamlines the appraisal process for U.S.

Housing Wire

JUNE 17, 2024

According to Inside Mortgage Finance (IMF) estimates, Chicago-based Guarantee Rate was the ninth-largest mortgage lender in the country in the first quarter of 2024. The mortgage lender, which grew to 9,708 employees at its peak in 2021, shrank to 3,871 workers as of April due to a declining origination market.

Housing Wire

SEPTEMBER 1, 2021

Finance of America Reverse. SVP, Secondary Marketing Manager. Senior Director of Strategic Finance. HR Director. Director of Strategic Finance and Analytics. Finance of America Reverse. Finance of America Mortgage. Senior Manager of Customer Engagement and Marketing Technology. Amanda Overton.

Housing Wire

DECEMBER 8, 2021

In response to the PR nightmare, members of Better’s communications team, including head of public relations Tanya Hayre Gillogley, head of marketing Melanie Hahn, and vice president of communications Patrick Lenihan, all submitted resignations this week, according to a source familiar with the matter. In doing so, I embarrassed you.”.

Housing Wire

JULY 18, 2022

WesBanco Bank , the second-largest bank headquartered in West Virginia, plans to hire at about a dozen loan originators in 20 major markets this year. Several large mortgage brokerages see the market-wide volatility as a recruiting tool. Casa plans to also hire for data, IT, operations and HR roles.

Housing Wire

JUNE 7, 2022

Few other industries must deal with the level of complexity of home finance. Originators will lose out to quicker competitors, especially in a purchase money market. In a highly competitive market, margins are the first to be sacrificed, making the problem even worse. Challenge 2: Shrinking margins.

Housing Wire

DECEMBER 7, 2023

Student has 30 days to complete 40-hr course, access course Mon-Sun Exam Prep $199 National PSI & Pearson Vue Salesperson Refresher Course: Webinar. Features Commercial Lease Clauses of Tenant Concerns: Part III and other residential courses C Gold Package 12 Hrs: Includes 12 hrs of CE for MA commercial real estate.

Housing Wire

DECEMBER 26, 2023

Prices Starting at Prelicensing $715 Exam Prep $79 Post-licensing CE $249 Prelicensing Pricing Career Accelerator Career Builder Career Essentials $1079 $795 $715 All Career Builder Features + NC Post-Licensing Package All Career Essentials Features + Business Building Courses Required 75-hr NC prelicensing coursework.

Housing Wire

FEBRUARY 15, 2022

The SEC report offers a portrait of the regulatory process ongoing behind the scenes in the rating-agency world, which is a key to maintaining transparency for investors and issuers across a range of markets. HR Ratings de Mexico and Japan Credit Rating Agency Ltd. Market Share. market share based on loan-pool value.

HomeLight

AUGUST 30, 2024

Wondering how much your Boise home is worth in today’s market? With this increase in prices, the Boise market looks promising for homebuyers who hope to see their property value appreciate over the next several years. This trend is expected to be followed even in the coming years, making more sense to buy in the market,” said Tricoli.

Housing Wire

NOVEMBER 13, 2023

Course also covers Florida Real Estate Law and Contracts, Valuation, appraisal, financing, federal income tax laws, zoning and planning, environmental issues & more. The CE Shop pricing Education Type Prelicensing Exam Prep Post-License CE Broker Prelicensing Starting at $104.25 $101.25 $115 $221.25

Afford Anything

NOVEMBER 9, 2020

Do you wrestle with the idea of leaving your savings in an account earning next to nothing versus investing it in the stock market? Morgan Housel, author of The Psychology of Money , joins us to discuss why investing is not the study of finance, but the study of how people behave with money.

Afford Anything

AUGUST 18, 2021

Here are some other topics we discuss: The democratization of finance. The financial markets are flooded with new investment vehicles and digital financial products — and your take on these probably reflects your age. Finance mindset vs. tech mindset. Gusto makes payroll, benefits, and HR easy for modern small businesses.

Afford Anything

FEBRUARY 9, 2021

Next Gen Personal Finance. Gusto makes payroll, benefits, and HR easy for modern small businesses. Resources Mentioned : Chris Pederson’s articles. Ben Carlson’s blog, A Wealth of Common Sense. PaulMerriman.com. We’re Talking Millions! , by Paul Merriman. – Paula. Thanks to our sponsors!

Afford Anything

JUNE 10, 2025

We’re estimating a housing budget of $500,000, which should be enough to get us into a good school district with access to strong job markets. Given our ages, net worth, and timeline for reaching work-optional status, how should we approach financing this home? That number could be higher or lower depending on what we find.

Toronto Realty Blog

FEBRUARY 20, 2025

I always love getting different perspectives on our real estate market, the Canadian economy, the world’s economy, or just chatting about business in general. 80%), one of the major banks will finance the project and give the go-ahead to begin construction. We covered a lot of ground! A condominium is a corporation.

Afford Anything

MAY 20, 2025

Someone brought up sequence of returns risk, and it got me thinking about how to manage finances when you’re nearing FI. I imagine many longtime listeners are in a similar place—we’ve been working toward FI for years, and after a mostly favorable market run, we’re getting close to our goals.

Realty Biz

JUNE 13, 2022

Feltch will lead all aspects of finance, financial strategy, and accounting. The post CAIRN REAL ESTATE HOLDINGS EXPANDS LEADERSHIP TEAM appeared first on RealtyBizNews: Real Estate Marketing & Beyond. Before joining Cairn, Flohr was a General Manager at Berkadia Commercial Mortgage.

Afford Anything

DECEMBER 7, 2020

Josh also chats about the five fundamental parts of every business – value creation, marketing, sales, value delivery, and finance – that everyone should master. Gusto makes payroll, benefits, and HR easy for modern small businesses. In fact, 72% of customers spend less than 5 minutes to run payroll!

HomeLight

MARCH 31, 2022

However, In the current housing market where sellers are often receiving multiple offers on a home, larger down payments can make an offer more competitive, not to mention keep the monthly payment lower. So how can first-time homebuyers get into the housing market and craft the most competitive offers?

Afford Anything

JULY 6, 2020

An anonymous listener, whom we call “Mary,” is curious about the auto-rebalancing feature offered by M1 Finance. If so, is now a bad time, considering the market volatility? Anonymous “Mary” asks (at 1:36 minutes): I’m curious about investing with M1 Finance. The market is so volatile — what should I consider?

Fancy Pants Homes

AUGUST 14, 2024

With its thriving job market, world-famous live music scene, outdoor activities, and unique local cuisine, Austin has long been attracting new residents from outside state lines. In the winter of 2019, while spending time with family in Austin, I decided to casually check out the local housing market,” Wendy reminisced.

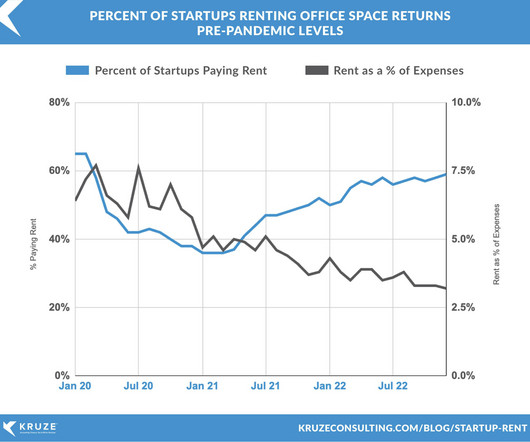

Broke Agent Media

APRIL 21, 2023

That’s according to new data from Kruze Consulting , a leading CPA and finance consulting firm for venture capital-backed startups. In early 2020, that figure was consistently about 7%, even in high-rent markets like New York. There’s a catch, though.

Afford Anything

AUGUST 2, 2021

I cancelled the whole life policy in March 2020 and invested the $30,000 cash value of that policy in the market. This is 25-30x the fees on VTI, the total stock market ETF I invest in for my brokerage account. This is 25-30x the fees on VTI, the total stock market ETF I invest in for my brokerage account. Is no tax a win?)

Afford Anything

NOVEMBER 20, 2020

She isn’t sure if she should keep her savings in the market. However, in the PSA episode about building an emergency fund , you advised us not to put money in the market if we want to access it in less than 15 years. It couldn’t be financed due to structural issues.) Should she move her money, and where?

Afford Anything

JUNE 17, 2025

But it feels like we wouldn’t get another used car loan below 6 percent in today’s market. NetSuite NetSuite is the number one cloud financial system, bringing accounting, financial management, inventory, HR, into ONE platform, and ONE source of truth. Or even dip into taxable investments to pay this one off?

Afford Anything

OCTOBER 4, 2021

I approach finances conservatively because my income fluctuates. With a baby on the way and concern about a potential downturn in the real estate market (and thus my income), I’m wondering what action I can take to put us in a secure position? What do you think about the Miami market? It’s cheaper and easier to acquire.

Afford Anything

OCTOBER 19, 2021

Gusto makes payroll, benefits, and HR easy for modern small businesses. There are no manual trades, picking stocks, or watching the stock market every day with Wealthfront. Every 28 seconds an entrepreneur makes their first sale on Shopify! In fact, 72% of customers spend less than 5 minutes to run payroll! Wealthfront.

Afford Anything

JANUARY 25, 2021

She also wants to investigate whether a Vanguard Institutional 500 Index Trust and a Vanguard Institutional Total Bond Market Index Trust are ideal. The remaining amount is in a Vanguard Institutional Total Bond Market Index Trust (BTBMK). Gusto makes payroll, benefits, and HR easy for modern small businesses.

Afford Anything

JANUARY 10, 2022

Is the stock market too risky for such a short time horizon? Gusto makes payroll, benefits, and HR easy for modern small businesses. Mike has $60,000 in cash earning one percent interest. He has plans to buy a home and get married in three to five years. Where else can he put his cash to earn a little more?

Housing Wire

FEBRUARY 5, 2025

Choosing the right real estate niche (or niches) will help you gain expertise, sharpen your career focus and protect yourself from sudden market fluctuations. While the luxury market is lucrative, it can be very difficult to break into.

Housing Wire

MARCH 21, 2024

It is extremely disheartening for anyone who’s in the market for a new home, including repeat and first-time homebuyers. The first is HR 7480, known as the Disabled Veterans Housing Support Act, sponsored by Rep. The third bill, HR 5837, known as the Protecting America’s Property Rights Act, is sponsored by Rep.

Housing Wire

NOVEMBER 30, 2023

Business Ebooks by Industry Experts, Career Resources, Downloadable Resources, Digital Flashcards, Real Estate Glossary & Study Schedule Standard: All Basic Features + Exam Prep Edge (National and Ohio) and Pass Guarantee Value: All Standard Features + Business Building Courses Premium: All Value Features + The CE Shop 20-Hr.

Housing Wire

DECEMBER 20, 2022

With the passage of HR 7735, known as the “Improving access to the VA home loan benefit Act of 2022,” the VA is now permitting desktop appraisals, and in some circumstances, waiving appraisals altogether. .” Senate this week passed a bill that streamlines the appraisal process for U.S.

Afford Anything

MAY 14, 2025

When I grew up, we didn’t have much insider access to personal finance and investing. We had Money magazine and a finance book from the local library. For one, the opportunity cost of investing in property versus the stock market isn’t as significant here. Only 20 percent of Britons invest in the stock market.

Afford Anything

JUNE 13, 2025

NetSuite NetSuite is the number one cloud financial system, bringing accounting, financial management, inventory, HR, into ONE platform, and ONE source of truth. Constant Contact Constant Contact makes it easy to promote your business with powerful tools like email and SMS marketing, social media posting, and even event management.

Housing Wire

MARCH 20, 2025

The top executives at Freddie Mac , along with a top HR official at the Federal Housing Finance Agency (FHFA), were fired today, according to a report on SEMAFOR. The publication reported that Freddie Mac s CEO, COO and head of HR plus the FHFA’s COO and head of HR were all fired on Thursday.

Housing Wire

MARCH 24, 2025

Amid a series of shakeups last week at the government-sponsored enterprises (GSEs) and its regulator, the Federal Housing Finance Agency (FHFA), two office closures inside the agency could hamper its fair lending and data gathering efforts that support the broader mortgage industry. Pulte has moved swiftly to reshape the posture at the GSEs.

Notorious ROB

DECEMBER 19, 2022

I think they were kind of forced into it a bit early due to the Jerome Powell housing market, but if that’s true… well, then that’s Opendoor showing out. There’s a long way to go before people will associate Zillow with financing, the way that they associate Rocket with mortgages. Ready or not, here they come.

BAM Media

MARCH 21, 2025

More changes at Freddie Mac and the Federal Housing Finance Agency (FHFA) took place yesterday. According to various reports, several top executivesincluding Freddie Macs CEO Diana Reid and key FHFA officialswere fired, signaling a major shift in leadership at the agencies that back nearly half of U.S.

Redfin

NOVEMBER 19, 2024

Major industries in Florida include healthcare, finance, retail, and telecommunications, each offering stable job opportunities. Top employers in Florida Publix Super Markets: 161,000 employees Walmart: 119,000 employees Walt Disney Co.: BankUnited and Seacoast Bank employ professionals in finance, customer relations, and IT.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content