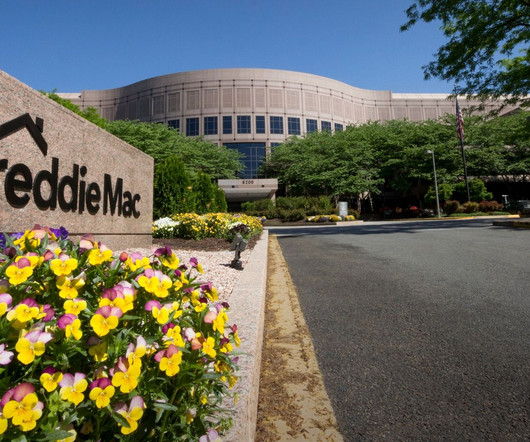

FHFA replaces Freddie Mac board member amid other changes

Housing Wire

APRIL 1, 2025

The Federal Housing Finance Agency (FHFA) continues to make leadership changes at the board and executive levels of Freddie Mac and Fannie Mae. Following that news, Freddie Macs CEO Diana Reid, COO and head of HR, plus the FHFAs COO Gina Cross and head of HR Monica Matthews were fired on March 20.

Let's personalize your content