Opinion: How did homeowners get into home equity prison?

Housing Wire

MARCH 26, 2024

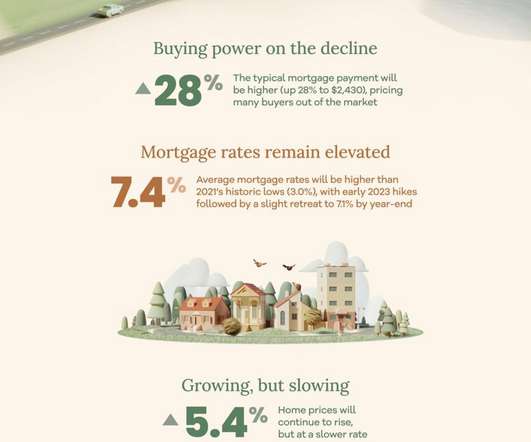

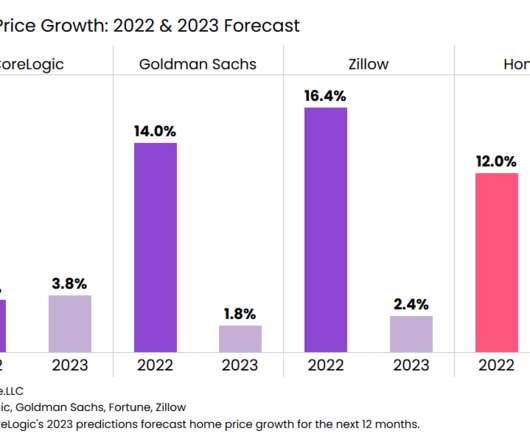

Even though they have a low mortgage rate on their home loan, the pandemic causes unanticipated financial hardships which lead to a decrease in their annual income as well as the necessity of using credit cards for their basic needs. Then, the housing market takes off like a rocket with home values exceeding all expectations.

Let's personalize your content