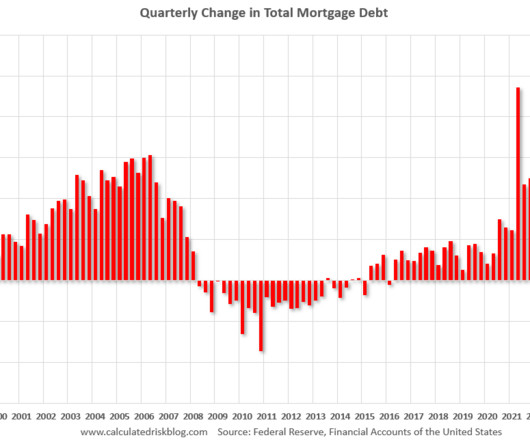

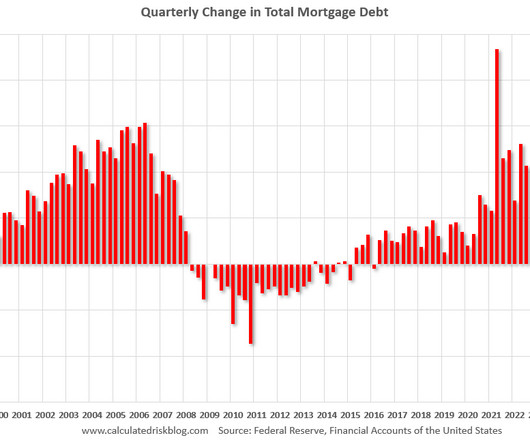

Home prices and mortgages keep rising, and it might get worse still

Housing Wire

OCTOBER 2, 2023

Even on a non-adjusted basis, August’s gain of 0.24% was more than 60% larger than the 25-year average for the month, according to a mortgage monitor report from Intercontinental Exchange, Inc. The high-interest rate environment continues to put downward pressure on mortgage origination activity.

Let's personalize your content