Home equity won’t be enough to prevent foreclosure for some

Housing Wire

OCTOBER 1, 2021

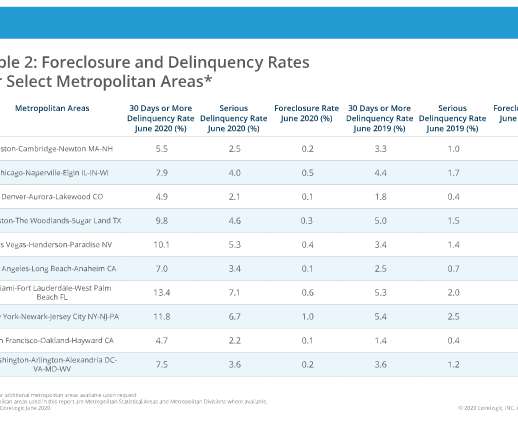

Despite record-high home prices, home equity may not save some borrowers in forbearance from foreclosure, according to a Black Knight ’s report published Monday. Since 2010, around 10% of borrowers with more than 120 days in delinquency were referred to foreclosure, regardless of their equity.

Let's personalize your content