Buy the Worst House in a Nice Neighborhood

Realty Biz

JUNE 30, 2022

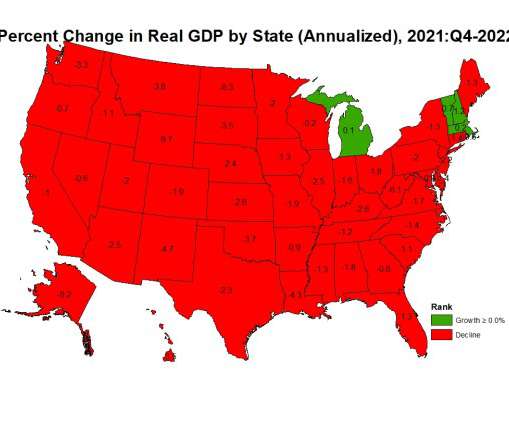

Some people call it buying the worst house in the best neighborhood, but most nice neighborhoods work just fine – especially when houses to choose from are scarce. But either way, this equity-building strategy isn’t for the faint of heart. Back Door Entry to a Ritzy Area. The theory is that lower-priced homes in upscale neighborhoods will appreciate at a higher percentage than all the other houses in the neighborhood.

Let's personalize your content