Competition for mortgage underwriters has never been fiercer

Housing Wire

NOVEMBER 30, 2021

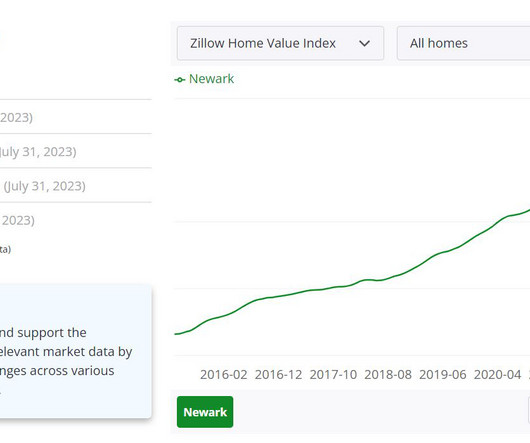

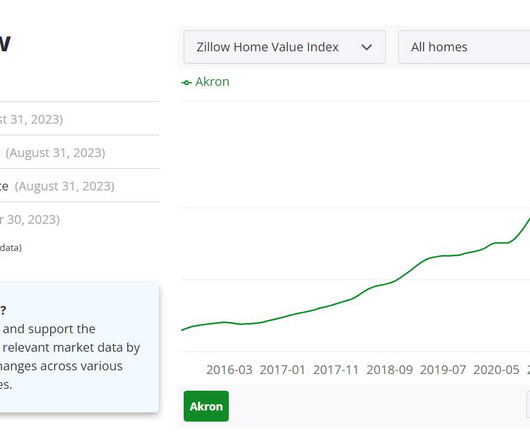

Record-setting mortgage originations coupled with a resurgent private-label securitization market have created an expanding demand for loan underwriters at a time when they are in scarce supply. . A recent report from the Federal Reserve Bank of New York illustrates the explosion of mortgage originations during the past year.

Let's personalize your content